The Kelly Criterion

The Kelly Criterion is one of the world’s most well known and popular betting strategies. Named after its creator John Larry Kelly, the Kelly Criterion has been in use since the 1950s. Commonly used throughout sports betting, the Kelly Criterion aims to increase the ROI on any bet as well as maximising your betting potential.

Although the Kelly Criterion makes a bold promise to maximise your winnings and reduce your losses to a minimum, it’s often easier said than done. Read on to find out just how the Kelly Criterion works in practice as well as its advantages and disadvantages.

What is the Kelly Criterion?

At its most basic the Kelly Criterion is a mathematical formula that helps guide you to making the best possible stake for your bet. The Kelly Criterion is used by punters and betting companies alike, which goes some way to telling you just how established it is as a betting strategy.

Take note that the formula the Kelly Criterion is based on is only useful if you already believe there is value to your bet. If there’s no value in your bet then the Kelly Criterion itself will be made redundant.

Before using the formula always bear in mind that it should only be used according to two principle criteria:

- To maximise winnings on a bet that already has value

- Or to minimise your chances of going bankrupt

How does the Kelly Criterion actually work?

Tto be able to use the Kelly Criterion you have to know how it actually works in practice. Although it does involve a bit of maths, it’s actually quite simple to figure out.

The Kelly Criterion works on the notion that the stake you back your bet with should be equal to the probability of it winning, minus the probability of it losing. Sound complicated? It really isn’t.

For example, let’s say you think your bet has a 55% of winning and a 45% of losing.

By using the Kelly Criterion can determine how much of your bankroll you should choose to use for that bet by doing a simple sum of 55 - 45 = 10.

That means 55 (the percentage probability you think your bet will win) minus 45 (the percentage probability you think your bet will lose) will give you 10. Therefore you would stake 10% of your betting bankroll on that bet.

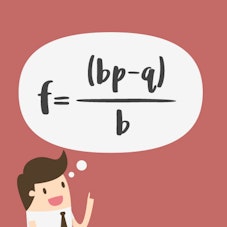

The Kelly Criterion formula:

(bp – q) / b = f

b = the decimal odds -1

p = the probability of winning

q = the probability of losing (1 -p)

f = How much of your bankroll to bet

(probability of win x odds-1) / odds-1 = bet stake

For example:

Let’s say you want to place a bet on Tottenham winning at home against Arsenal. According to your reckoning Arsenal’s chance of winning is 50%. That means there’s also a 50% chance of the match finishing in a draw or a Tottenham win. The betting company is offering you odds of 2.10 on an Arsenal win. In this case the Kelly Criterion formula would look like this.

(0.50 x 2.10 – 1) / (2.10 – 1) = 0.045

That means that according to the Kelly Criterion you should stake 4.5% of your bankroll on this particular bet because that is the same percentage advantage you have over the odds.

Disadvantages with the Kelly Criterion

- Means you have to be able to calculate the exact probability

- Can get complicated if you stake on multiple bets at the same time

- Can lead to losses

1. One of the biggest drawbacks with this betting strategy is that it can’t help you calculate the initial probability you need to move forward. Finding value in the odds market is difficult, and what’s even tougher is being able to accurately calculate the percentage probability for any match. The margins are slim and in order to determine the exact probability of a particular bet coming through being either 52% or 54% requires experience and knowledge.

2. The second disadvantage with the Kelly Criterion is if you want to play multiple bets at the same time or combine several bets into an acca. It is extremely difficult to calculate the probability when using multiple bets if you want to apply the Kelly Criterion.

For example:

- Match 1 has a probability of 35%

- Match 2 has a probability of 25%

- Match 3 has a probability of 18%

- Match 4 has a probability of 27%

According to the Kelly Criterion if you were to place a bet on each of these matches together then the probability of it winning would be 105% which is impossible.

3. Another potential issue is that it can change the makeup of your bankroll drastically. Of course it’s a distinct possibility that your bankroll can grow considerably, but it could also be damaging. For example if you find that the Kelly Criterion says your probability is 50% and you follow it through you’ll be staking 50% of your overall bankroll which is a risky venture on any bet.

The Fractional Kelly Criterion

Based on this system’s pros and cons, over the years many different variations of the Kelly Criterion have been created. The most well known is the fractional version of the Kelly Criterion.

The principle stays the same except that whatever result you get from the formula you would essential split that the percentage. For example if the Kelly Criterion stipulates that the value of a bet is 50% and you don’t want to bet that much of your bankroll, you would simply split that percentage to a number that you’re more comfortable with.

The important thing to remember with this method is to apply the same percentage reduction across all of your matches.

The fractional Kelly Criterion betting strategy is popular with many punters simply due to the fact that it’s less risky.

For example:

Let’s say you’ve found a bet that you value at 10%. If you follow the standard Kelly Criterion you would then correspondingly stake 10% of your bankroll. If you think that staking 10% of your bankroll for this bet is too high you would decide to half it and stake 5% instead.

This would mean that your potential winnings would be smaller but the risk isn’t as great. By using the fractional method the chance for long term profit increases. After all, betting isn’t a sprint but rather a marathon.